Purchase of receivables or selling of receivables is one of the more effective ways to improve the liquidity of any company. Are you interested in the the topic of this financial service and the course of the procedure for purchase of receivables?

Purchase of receivables ~ selling of receivables

Are you offering deferred payment period of 30, 60, 90 days, (30, 60, 90 or more? 120 dni)?

Then it definitely affects your cash flow.

In order for business to run smoothly, the sale of undue receivables is the solution

to improve liquidity, growth and successful operation of your company.

Purchase of receivables offers various benefits:

- If you are in a need of funds and have a receivable with maturity that does not cover the need of your cash flow.

- If you are in a need of funds to expand sales or penetrate new markets.

Purchase of receivables is a process of money circulation, completed only when payment is received for goods sold or services provided. Companies can offer their outstanding and receivables in exchange for immediate payment to company Prva finančna agencija and shorten the time of money circulation.

Favorable financing in seasonal fluctuations or sudden increases of the turnover.

Easier planning and managing of the cash flow.

Faster circulation of funds.

Improvement of financial indicators in the balance sheet.

Keeping same credit limit with the bank.

Maintaining good relationships with your customers.

In order for your business to run smoothly, purchase of receivables is the right way to improve the liquidity and creditworthiness of your company and, consequently, to grow and operate it successfully.

Are your receivables already due? Check our services:

- recovery of receivables or or

- purchase zapadlih receivables..

The difference between "purchase of receivables" and "selling of receivables"

The terms “purchase of receivables” and “sale of receivables” are extremely close, as they essentially describe the same legal transaction, only from a different point of view or perspectives. From the point of view of the buyer (Prva finančna agencija) we talk about purchase of receivables, z vidika prodajalca terjatve (podjetje oz. upnik) pa je govora o selling of receivables.

Procedure of purchasing receivables is very simple, since all we need is a copy of an invoice or documentation which proves the existence of receivables being sold. We will purchase your indisputable receivables on the basis of a contract.

We offer purchase of undue receivables, wherein the discount amount depends on maturity of the receivables, method of settling the receivables, creditworthiness of your debtor, and method of selling off the receivables (with or without a recourse recourse request). Discount for the purchase is agreed upon a case-by-case basis.

Receivables repurchase service or the sale of receivables consequently represents one of the possibilities of short-term financing. In practice, this means that you have sold goods or services to a company with a deferred payment deadline (30, 60, 90 or more days).

If you want to receive payment for the good operation of your company in the shortest time possible we have a solution for you: short-term financing - purchase of receivables / purchase of outstanding receivables. We purschase the receivable from you (as soon as you issue an invoice to the buyer) on the basis of the contract we conclude.

Purchase of receivables [selling of receivables] benefits many small, medium-sized companies as well as fast-growing companies that seek to improve liquidity and enable effective, safe and predictable cash flow.

Why choose purchase receivables service?

IMMEDIATE PAYMENT

Payment of your outstanding receivables with deferred payment deadline.

LIQUIDITY

Your company will have liquidity, as you will not have to wait for the payment of outstanding receivables with deferred payment by your customer.

CONSTANT CASH FLOW

Easier planning and cash flow management.

NEW BUSINESS OPPORTUNITY

Do you want new business opportunities, but this is not possible because you are waiting for a deferred payment from your customer?

GOOD CREDIT SCORE OF THE COMPANY

Due to better liquidity, your credit score will also improve, compared to poorer credit scores in the event of illiquidity, due to waiting for your customer to make the payment of outstanding receivables.

BETTER TERMS OF BUSINESS WITH YOUR SUPPLIERS

Liquidity allows you to settle liabilities to suppliers on time and take advantage of discounts (“discount”); in case of early payments.

LESS NEED FOR BORROWING

There will be no need for borrowing from banking institutions and there will be no need for lengthy short-term loan approval procedures.

Six reasons why you should sell off receivables to our company:

- we purchase domestic and international trade receivables,

- we monitor creditworthiness of your debtors,

- we improve your liquidity,

- we reduce the risk of your customers’ defaults,

- positive impact on your creditworthiness,

- acquiring funds is much faster than with banks.

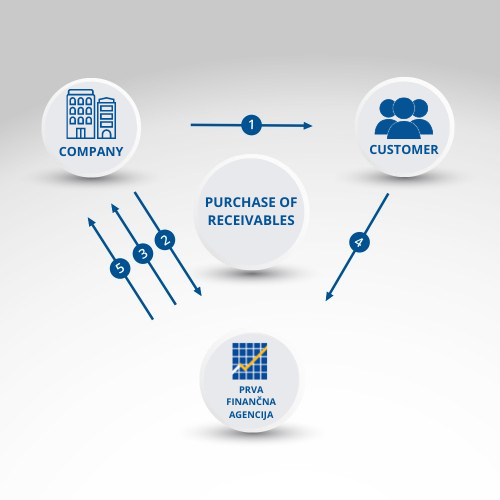

Purchase of outstanding receivables is a service that may seem complex at first glance. The process is actually very simple. Below we will describe in detail the case of the purchase of receivables [sale of receivables].

What is the process for purchase of receivables?

STEP 1:

The company supplies goods/performs services and issues an invoice with agreed maturity.

STEP 2:

The company sends this invoice to the Prva finančna agencija (PFA). Prva finančna agencija d.o.o.

STEP 3:

The PFA pays the company up to 100% of invoice value prior to its maturity.

The PFA pays the company up to 100% of invoice value prior to its maturity.

STEP 4:

The customer settles the invoice with the PFA at its maturity or within the agreed time limit.

STEP 5:

The PFA pays the company the remaining value of the invoice.

Healthy cash flow based on purchase of outstanding receivables [sale of outstanding receivables]

Every company strives for growth and successful business. And every company wants a healthy cash flow. However, it often happens that successful domestic and international companies face great challenges in financing their operations, as customers are now extending their payment deadlines or actively striving to do so.

While suppliers strive to keep payment deadlines as short as possible, they want to receive advance payments for their products. If you sell a deferred payment service or goods to another company, you may experience a “liquidity shortage”, which simply means that your cash flow is impaired and this may affect your future business.

HEALTHY CASH FLOW IS KEY TO THE EXISTENCE OF A COMPANY

We are aware that in addition to providing short-term financing (purchase of receivables), long-term financing and, last but not least, insurance of receivables are extremely important..

In this case we are talking about the factoring service, which is a financial tool with which we can finance and insure all receivables (existing and future). We can finance the receivables of one or more of your customers over a longer period of time.

Purchase of receivables or selling of receivables Purchase of receivables or selling receivables is one of the most effective ways to improve a company’s liquidity. If you are also interested in selling of receivables receivables. or selling of outstanding receivables, allow us to help you find the optimal solution. Send an inquiry or simply call us on +386 8 200 37 00. We will be happy to help you.