Domestic factoring

When you need financial resources, we guarantee early payment of your receivables in the amount of up to 100% of individual receivable. You get any remaining value of receivable at its maturity or when we as a factor receive payment from your customer.

Companies decide on domestic factoring because it ensures liquid assets for the same price, also when there is a lack of money on the market.

Advantages of factoring:

Possibility of financing at any time without borrowing

Financing when you need funds to penetrate new markets

Reduced need for borrowing – improving creditworthiness and maintaining the credit limit with banks

Favorable financing in seasonal fluctuations or sudden increases of the turnover.

Better predictability of cash flow - easier planning of cash flow and faster circulation of funds.

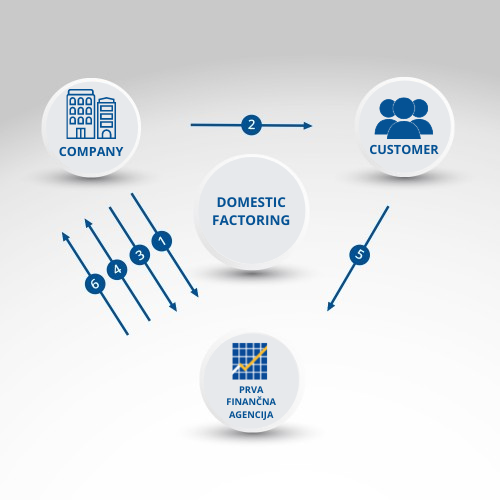

What is the process of domestic factoring?

Business process:

1. The company wants financing on the basis of receivables against a customer in Slovenia.

2. The company supplies goods/performs services and issues an invoice with agreed maturity.

3. The company sends this invoice to the Prva finančna agencija (PFA).

4. The PFA pays the company up to 100% of invoice value prior to its maturity.

5. The customer settles the invoice with the PFA at its maturity or within the agreed time limit.

6. The PFA pays the company remaining value of the invoice.