Reverse factoring

Reverse factoring Reverse factoring is a method of financing where we pay your supplier at the maturity or within the agreed time limit, and you settle your liabilities with us on deferred payment. In doing so, you can offer deferred payments to your customers and increase your company’s competitiveness on the market.

Advantages of reverse factoring:

The company’s liabilities towards their supplier are paid by us, the company settles their liability in the form of a deferred payment

As the company’s liabilities towards their supplier are settled by us before the maturity, the company gets additional discounts (discount for early payment)

Reduced need for borrowing

The company can offer longer payment periods to their customers – competitiveness on the market

Managing and planning cash flow to suit the company’s needs

Avoiding costs for letters of credit and bank guarantees that the supplier may demand

Who is reverse factoring intended for?

a) Companies that do not yet enjoy deferred payment terms from their suppliers

b) Companies that do not want to lower their credit potential

c) Companies that want to effectively manage their cash flow.

Use of this opportunity and contact us.

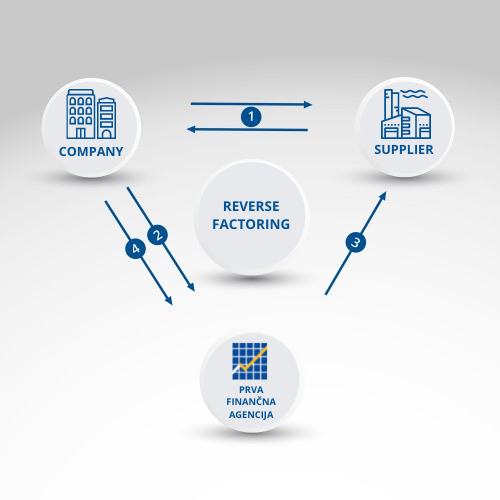

What is the process of reverse factoring?

Business process:

1. The company makes an order with the supplier and receives an invoice with agreed maturity for the supplied goods/performed services.

2. The company sends the supplier’s invoice to the Prva finančna agencija (PFA).

3. The PFA settles the invoice before or latest at its maturity upon agreement with the company.

4. The company settles its liabilities with the PFA in the form of a deferred payment.